Monarch Money Review: Your Guide to the Best Affordable Personal Finance Management Tool

Managing your finances can feel like trying to navigate a complex maze — bills to pay, budgets to track, investments to monitor — and often it’s easy to lose sight of your financial goals. But what if there was an intuitive, all-in-one platform that could bring clarity and control to your money management? Enter Monarch Money, widely recognized as the best affordable personal finance management tool designed for people who want to take charge of their financial future without the hassle.

Have you ever wondered how streamlined your financial life could be if all your accounts, bills, and investments were seamlessly connected in one app? How often do you find yourself juggling spreadsheets, transactions, and budget reminders with little success? Monarch Money aims to solve these common struggles by combining simplicity, automation, and deep insights into a single accessible tool.

In this article, we’ll dive into everything you need to know about Monarch — from actionable tips on personal finance management to honest reviews of what makes this tool stand out, including its strengths and a few gentle critiques. Ready to explore how Monarch Money could transform your approach to budgeting?

Unlocking Financial Success: How Monarch Money Elevates Your Budget Tracking & Wealth Monitoring

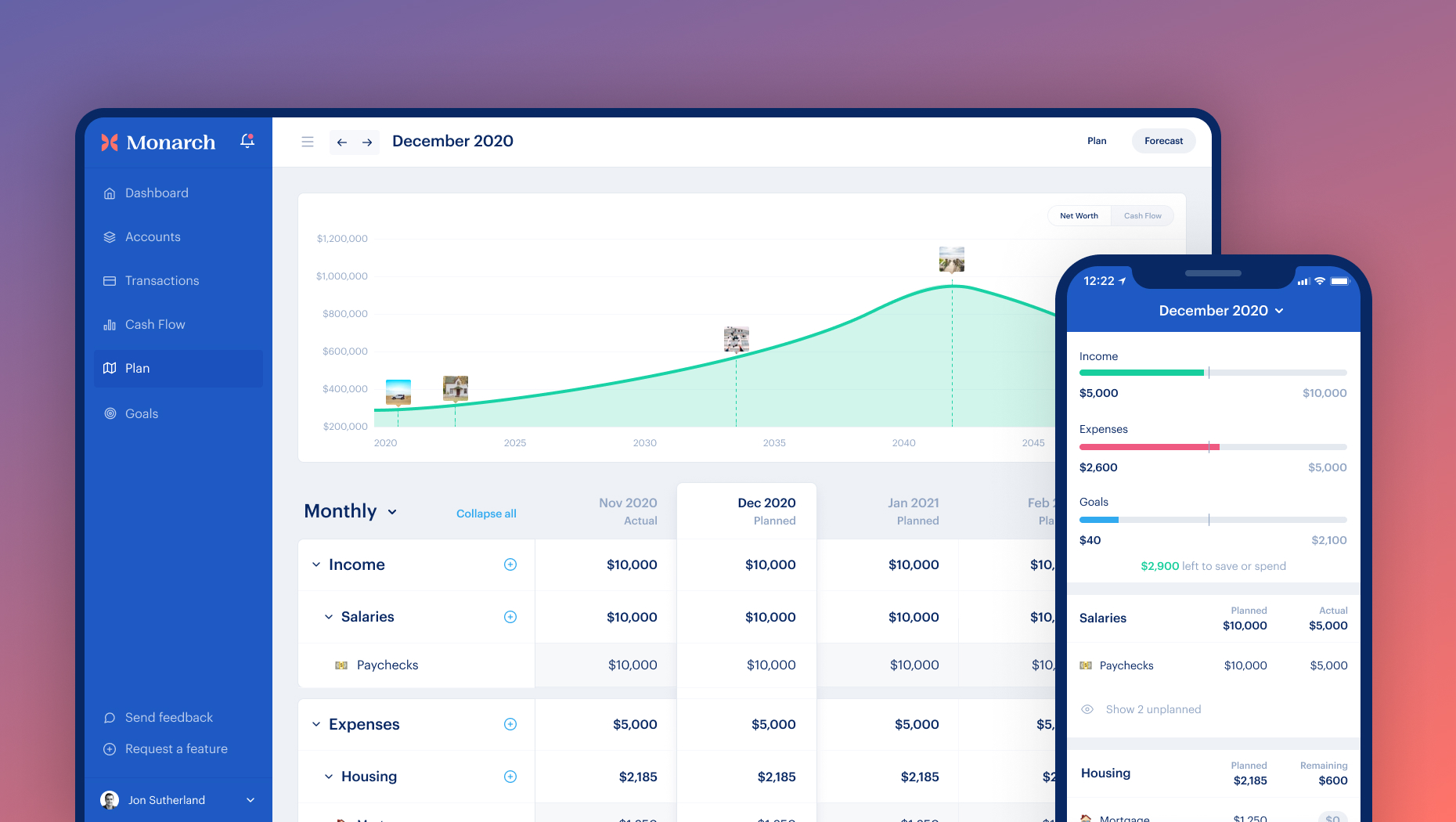

Personal finance management is more than logging expenses; it’s about gaining a comprehensive understanding of your entire financial picture. Monarch Money excels in this by offering a highly integrative platform where budgeting meets investment monitoring effortlessly.

Here are some practical ways Monarch helps improve your financial habits:

Automatic Account Syncing: Connect your bank accounts, credit cards, loans, and investment portfolios in one secure place. No more manual imports or scattered data.

Real-Time Budget Tracking: Monarch continuously updates your spending against custom budgets, helping you stay on track without guesswork.

Savings & Goals Planning: Whether saving for a down payment, retirement, or vacation, Monarch’s goal-setting features break down your targets into manageable, measurable milestones.

Net Worth Tracking: Easily visualize your net worth growth over time by integrating all your assets and liabilities.

Customizable Dashboards: Tailor your financial overview to prioritize what matters most—expenses, income, debts, or investments.

- Insightful Reports: Receive detailed break-downs of your spending habits and investment performance for smarter decision-making.

Let’s say you’re trying to save for a home while paying off student loans. Monarch can show how budgeting efforts and debt repayments intersect and offer projections on when you might reach your goals. Step-by-step, Monarch guides users toward financial clarity through practical, easy-to-understand insights.

Imagine no longer feeling overwhelmed during tax season or month-end budgeting because everything you need is at your fingertips, updated and accurate. How do you currently track your finances? Could a unified view motivate you to save more or spend smarter?

Monarch Money in Action: A Day in the Life of a User

Meet Sarah, a busy professional juggling student loans, a growing family, and saving for the future. Like many Americans, Sarah felt trapped by the tangle of multiple bank accounts, credit cards, and investments scattered across different platforms.

When Sarah discovered Monarch Money, it was a game changer. With all her financial data linked securely, she could instantly check her spending trends and adjust her weekly grocery budget without second-guessing.

One evening, Sarah sat down using Monarch’s intuitive interface to review her net worth timeline. She marveled at how seeing the slow but steady growth in her investments helped her stay motivated. The goal tracker reminded her gently that she was on pace to fund her daughter’s college savings plan three years earlier than expected.

Sarah’s story illustrates the emotional lift Monarch provides: confidence, reduced stress, and a clear path forward. It’s more than numbers—it’s about empowerment. Have you ever experienced that “aha” moment when a new tool or habit reshapes your outlook?

Monarch also made bill management effortless. Notifications ensured Sarah paid every bill on time, avoiding late fees and boosting her credit profile. Through Monarch’s easy-to-navigate platform, Sarah found herself less worried and more in control—turning financial chaos into peace of mind.

Weighing Monarch Money’s Strengths and Minor Drawbacks

Every product has its pros and cons, and Monarch Money is no exception. Here is a balanced look:

| ✔ Advantages | ✘ Disadvantages |

|---|---|

| ✔ Comprehensive Financial Integration: Connects banks, credit cards, loans, and investments seamlessly without multiple apps. | ✘ Subscription Cost: Monarch is a subscription-based service, which may not suit those preferring free budgeting apps, but its value often outweighs the cost. |

| ✔ User-Friendly and Intuitive Interface: Designed for users of all levels, it makes complex financial data easily accessible. | ✘ Mobile App Availability: While Monarch has a web platform, its mobile app is still developing, which may limit on-the-go accessibility for some users. |

| ✔ Robust Goal and Net Worth Tracking: Visuals and progress insights encourage consistent financial habits. | ✘ Limited Credit Score Monitoring: Monarch doesn’t provide in-depth credit score tracking like some competitors, but focuses more on holistic money management. |

| ✔ Strong Security Measures: Employs bank-level encryption and two-factor authentication to protect sensitive data. | |

| ✔ Customization Options: Allows personalized budgets, goals, and notifications suited to diverse lifestyles. |

Compared to competitors such as Mint or YNAB, Monarch shines with its integrated investment and debt tracking, providing a full financial ecosystem rather than just budgeting software. Its slightly higher price reflects the premium tools and support offered, which many consider a worthwhile investment.

Would the small trade-offs—like subscription fees or app limitations—deter you from trying Monarch if the payoff is better financial clarity? What features matter most in your finance app?

Real Feedback: What Monarch Money Users Are Saying

Jason M., Freelancer: “Monarch transformed how I manage irregular income. Budgeting used to feel impossible with fluctuating paychecks, but Monarch’s flexible budgeting and clear reports help me feel confident and prepared.”

Emily R., New Parent: “Between diapers and deadlines, Monarch’s auto-sync and goal features saved me hours. I finally understand where my money goes and how to boost savings. It’s like having a personal financial assistant.”

Kevin S., Investor: “I used to check investments on separate platforms, which was frustrating. Monarch’s all-in-one tracking keeps my entire portfolio and cash flow in view, making smarter investment decisions easier.”

Samantha L., Couple Planning: “My partner and I love Monarch’s collaborative budgeting. We set goals together and can both track spending in real-time, which improved our financial communication dramatically.”

David A., Retiree: “Retirement planning seemed out of reach until I started using Monarch. The net worth tracking and detailed spending breakdown helped me adjust my strategy and feel more secure about my future.”

These testimonials highlight Monarch’s versatility across different financial situations, from freelancers and families to investors and retirees. Each user notes the empowerment and peace of mind that come from having a clear, consolidated view of their money.

Are you inspired by any of these experiences? Which financial challenges resonate most with you?

Beyond Budgeting: Additional Benefits and Use Cases of Monarch Money

Monarch isn’t just for tracking budgets or investments—it supports a broad range of financial goals and lifestyles:

Debt Payoff Planning: Monarch offers detailed debt tracking tools, helping break down complex loans with timelines and payoff strategies.

Freelancer and Small Business Finances: Income tracking and expense categorization make Monarch a smart choice for entrepreneurs managing personal and business cash flow in one place.

Family and Household Finance Management: Shared access and multiple account syncing mean partners and families can coordinate finances transparently.

Tax Preparation Support: While not a tax software, Monarch’s comprehensive financial summaries simplify gathering necessary information for tax filing.

Financial Education: Monarch encourages users to learn as they track with clear visuals, prompts, and financial literacy tips embedded in the experience.

With Monarch, you can adapt the software to your unique situation, making it a versatile companion throughout life’s financial milestones. What new financial habits could you build if managing money was intuitive and visual?

Conclusion

In today’s fast-paced world, managing money effectively is both critical and challenging. Monarch Money emerges as the best affordable personal finance management tool, blending powerful financial integration, custom goal-setting, and user-friendly design in one platform. Whether you’re saving for major life events, aiming to reduce debt, or simply want daily clarity over your spending, Monarch offers a trusted, innovative solution.

Are you ready to revolutionize your financial journey? Intrigued? Find out why Monarch Money is becoming a must-have for savvy budgeters and wealth builders alike. Visit monarchmoney.com to see it in action and take the first step toward financial empowerment.